Projects

ESG Performance and Option Price

This capstone project delves into the intricate interplay between a company’s ESG performance and the dynamics of its options pricing within the market. Continue reading ESG Performance and Option Price

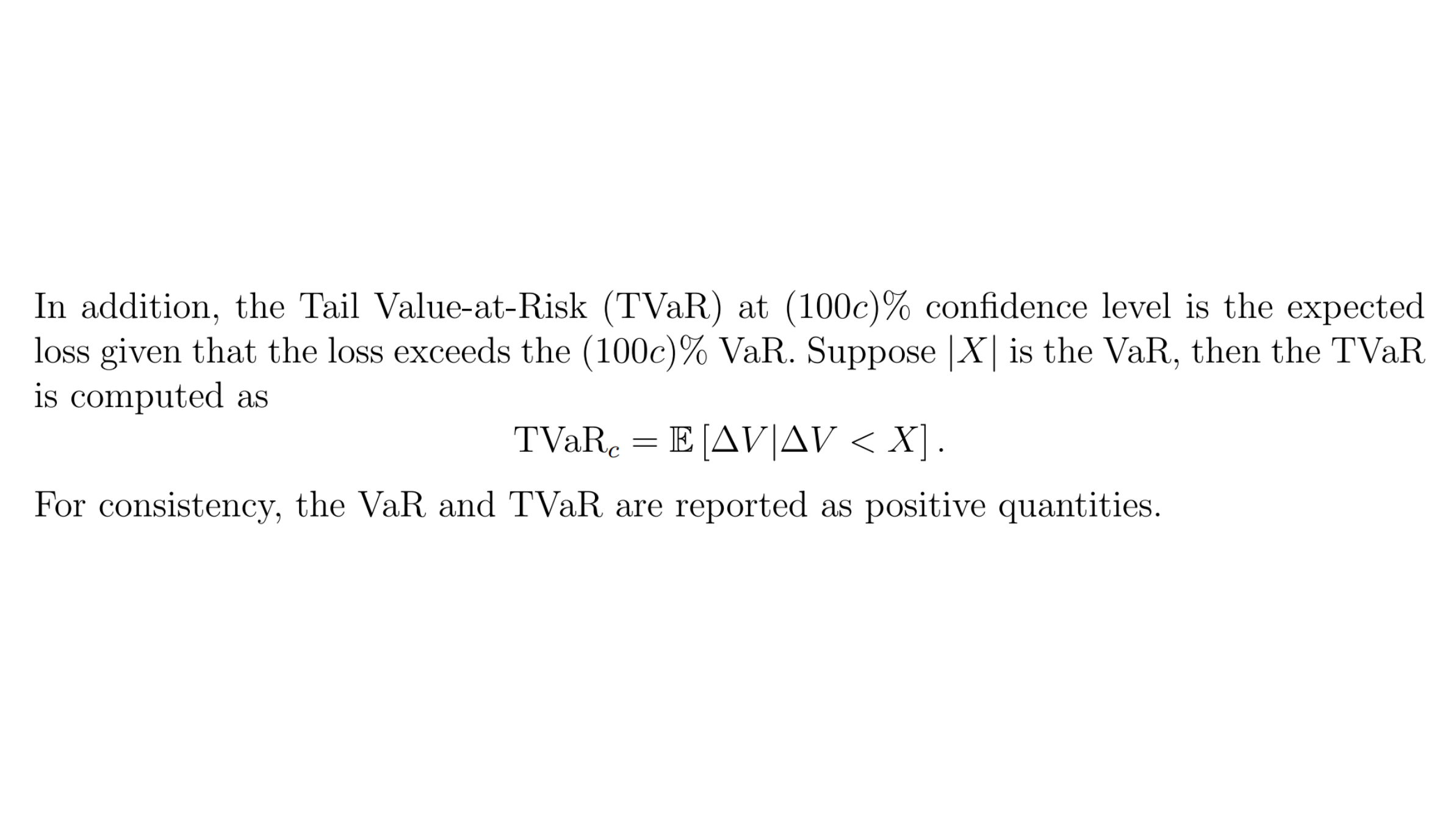

Value-at-Risk and Tail Value-at-Risk

This paper analyzes the Value-at-Risk (VaR) and Tail Value-at-Risk (TVaR) of three portfolios consisting of different types of financial instruments. Continue reading Value-at-Risk and Tail Value-at-Risk

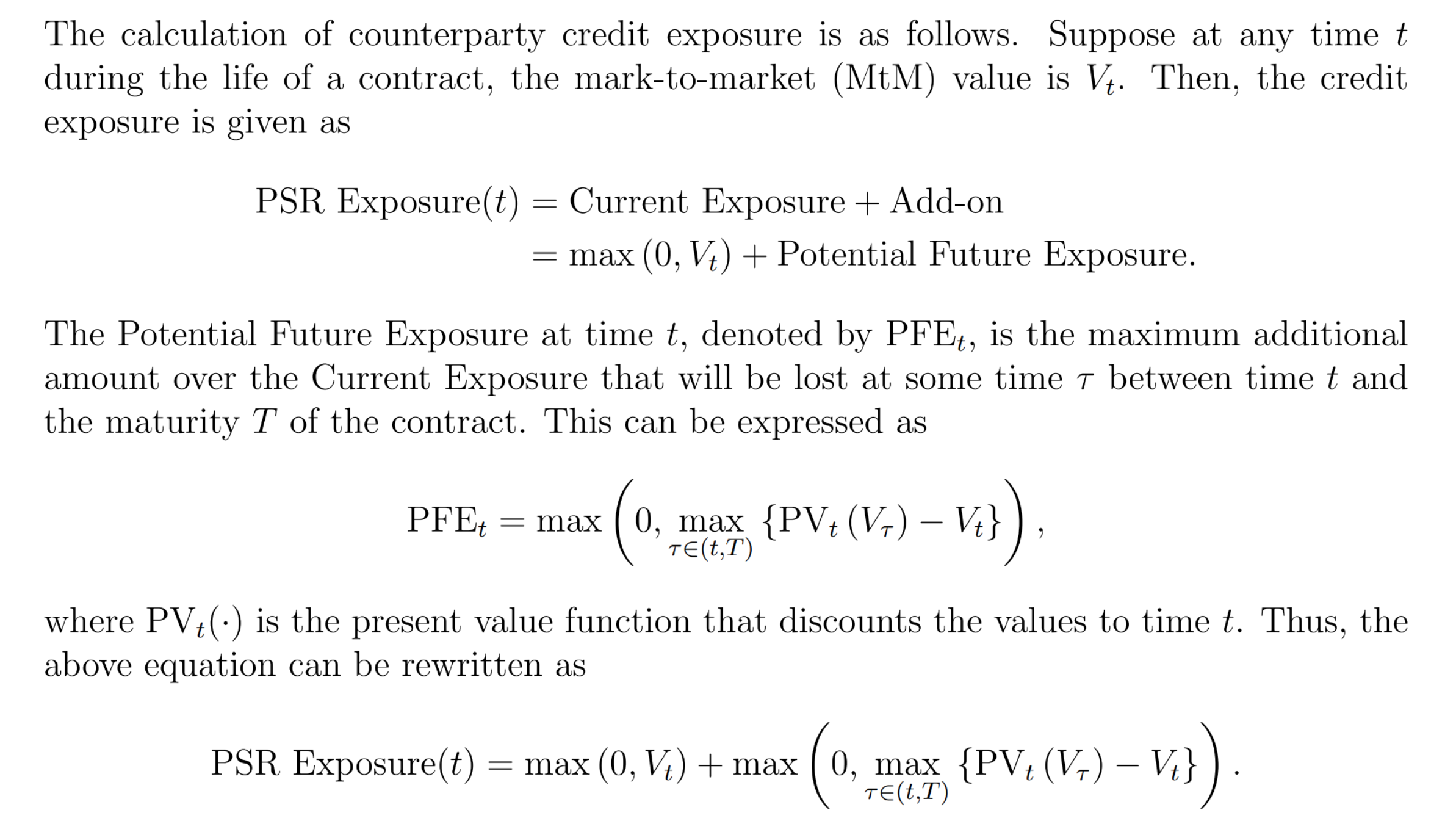

Pre-Settlement Risk

This paper analyzes the pre-settlement risk of two financial contracts using the Potential Future Exposure (PFE) factor approach. Continue reading Pre-Settlement Risk

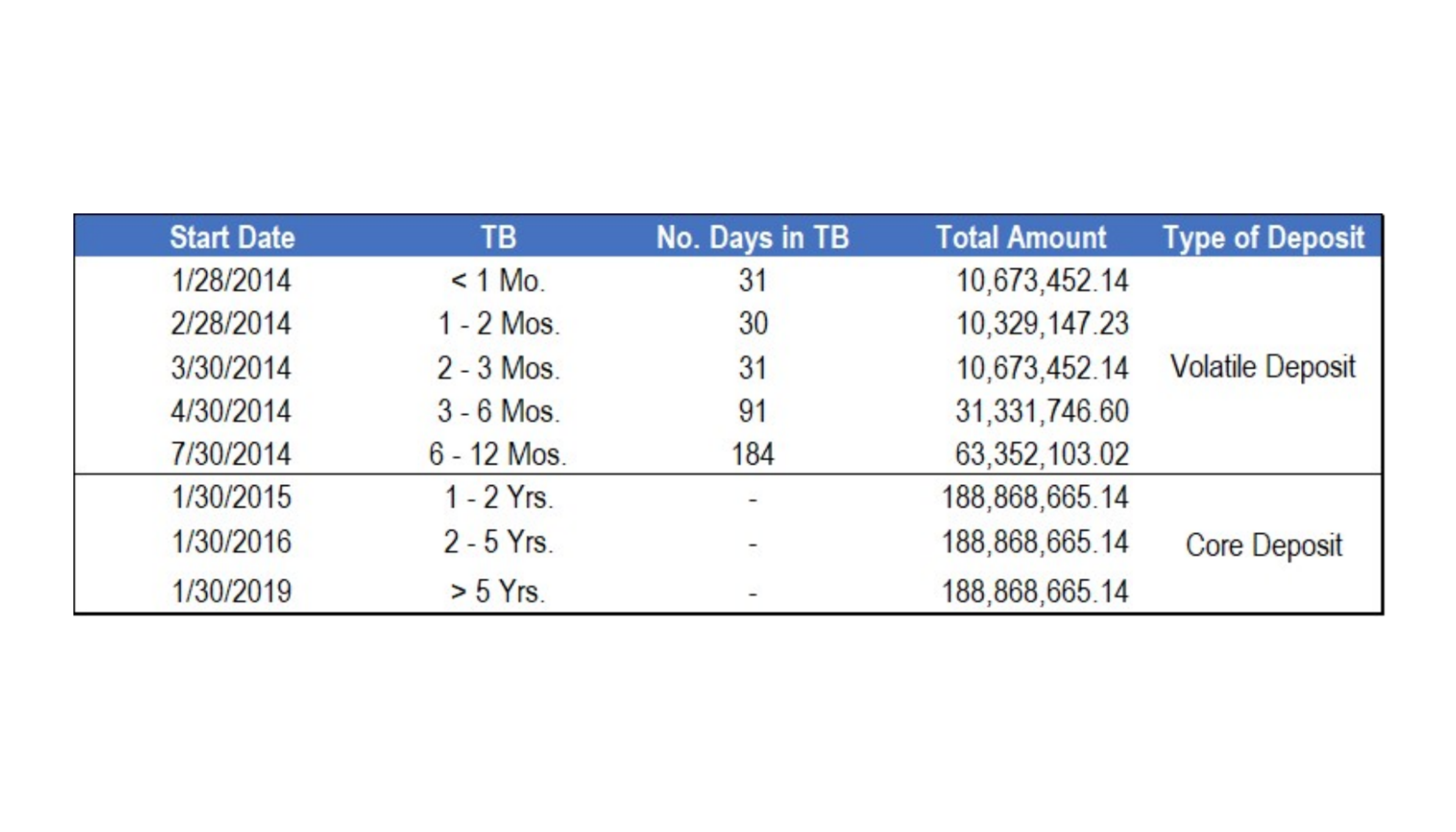

Liquidity Risk

This paper analyzes a bank’s exposure to liquidity risk using the Maximum Cumulative Outflow (MCO) report. Continue reading Liquidity Risk

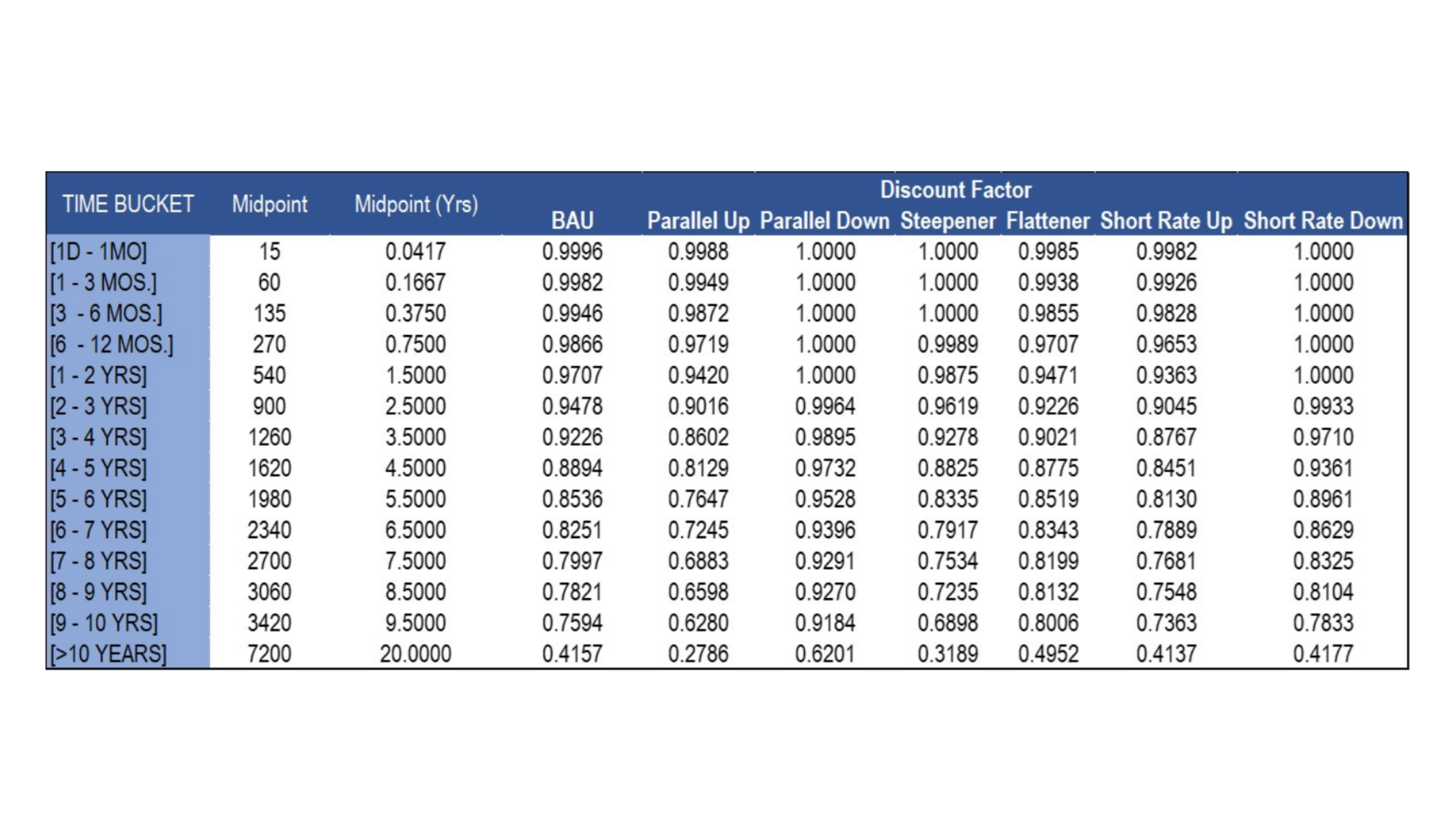

Interest Rate Risk

This paper analyzes a bank’s exposure to interest rate risk in its banking book using the Earnings at Risk (EaR) and Economic Value of Equity (EVE) approach. Continue reading Interest Rate Risk

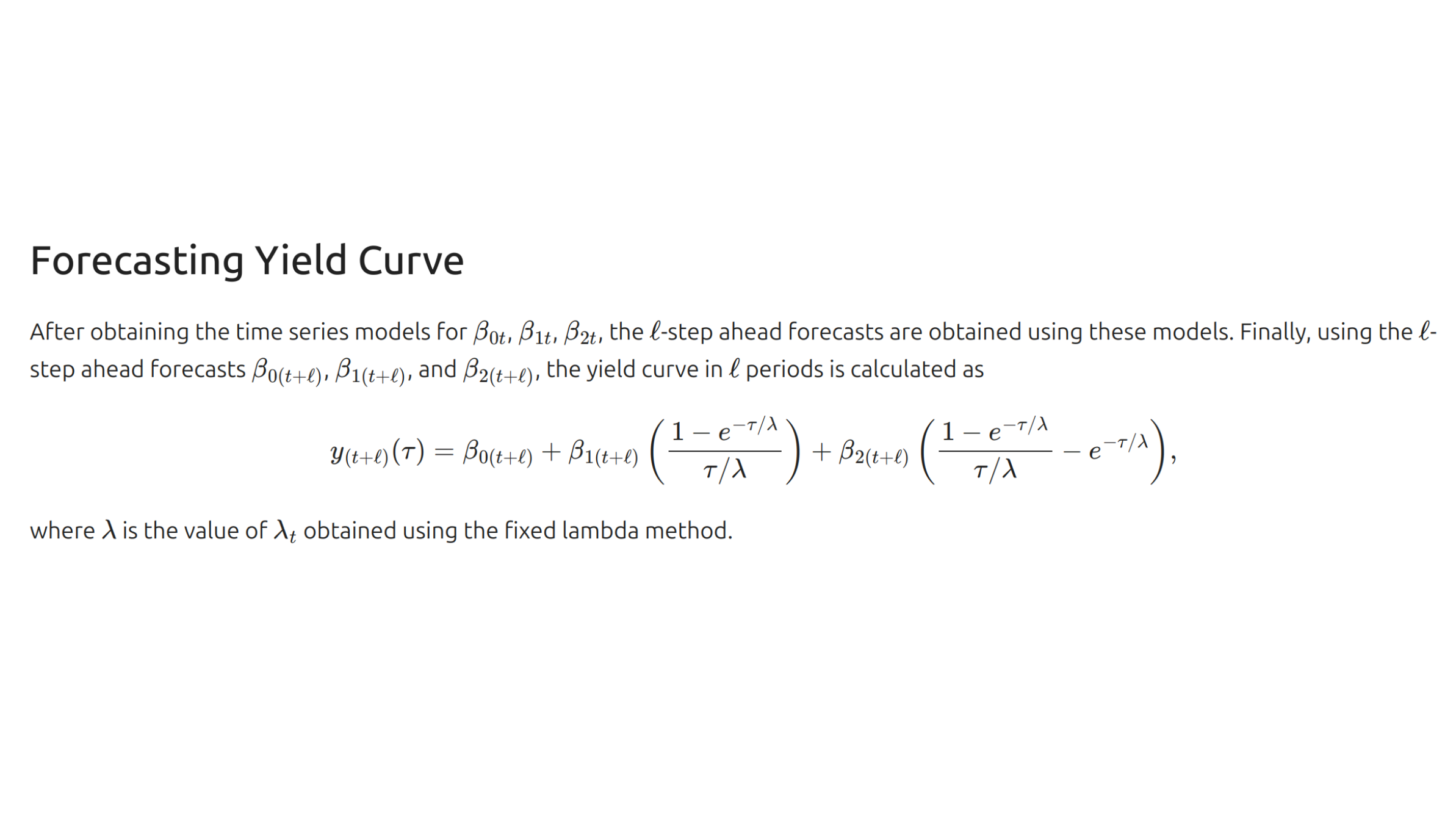

Dynamic Nelson-Siegel Model

This project explores the Dynamic Nelson-Siegel Model in forecasting the PDST-R2 rates and the yield curve. Continue reading Dynamic Nelson-Siegel Model

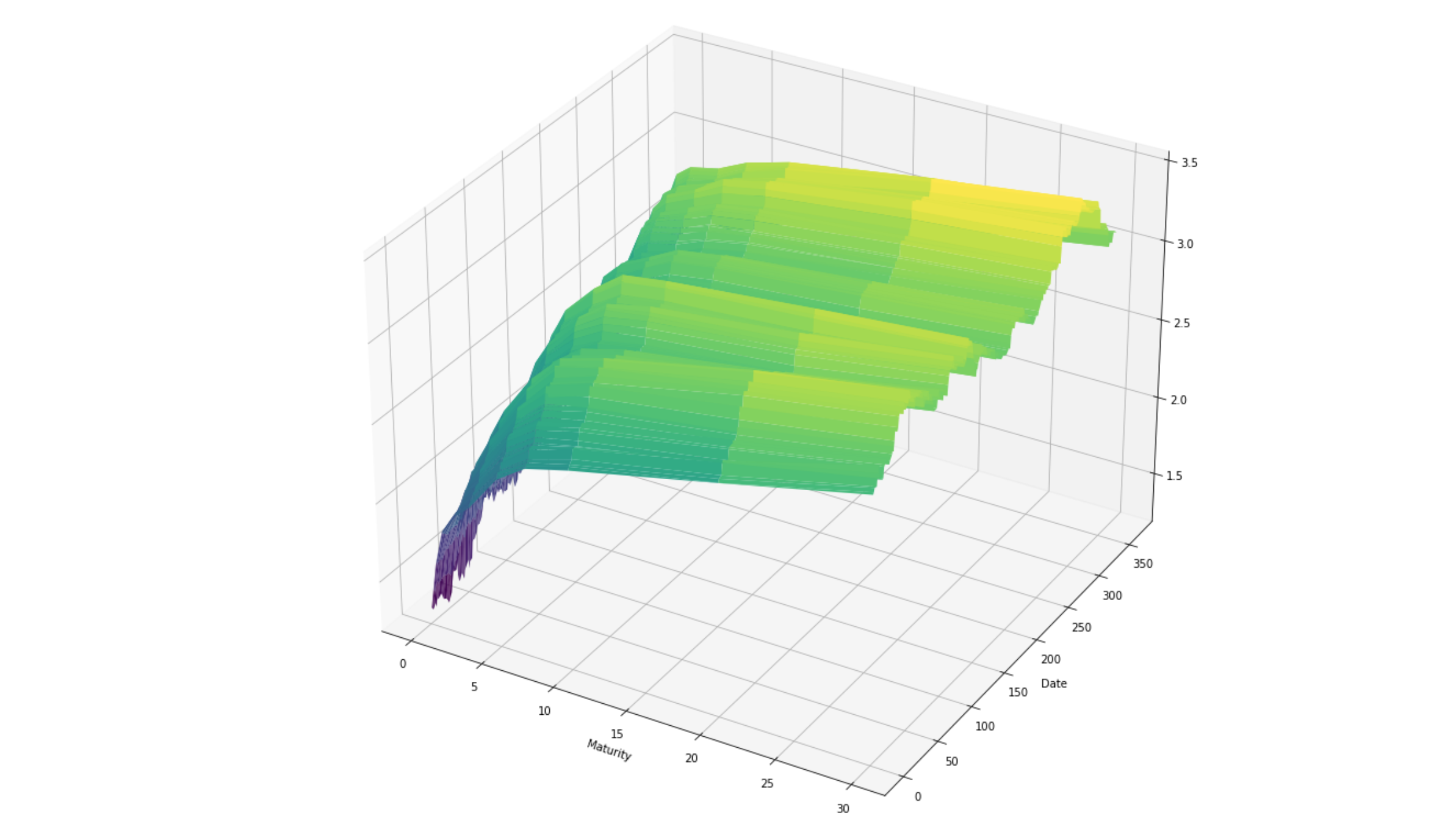

Cox-Ingersoll-Ross Model

This project explores the Cox-Ingersoll-Ross (CIR) model in forecasting the US Treasury short rates (3M interest rate) and the yield curve. Continue reading Cox-Ingersoll-Ross Model

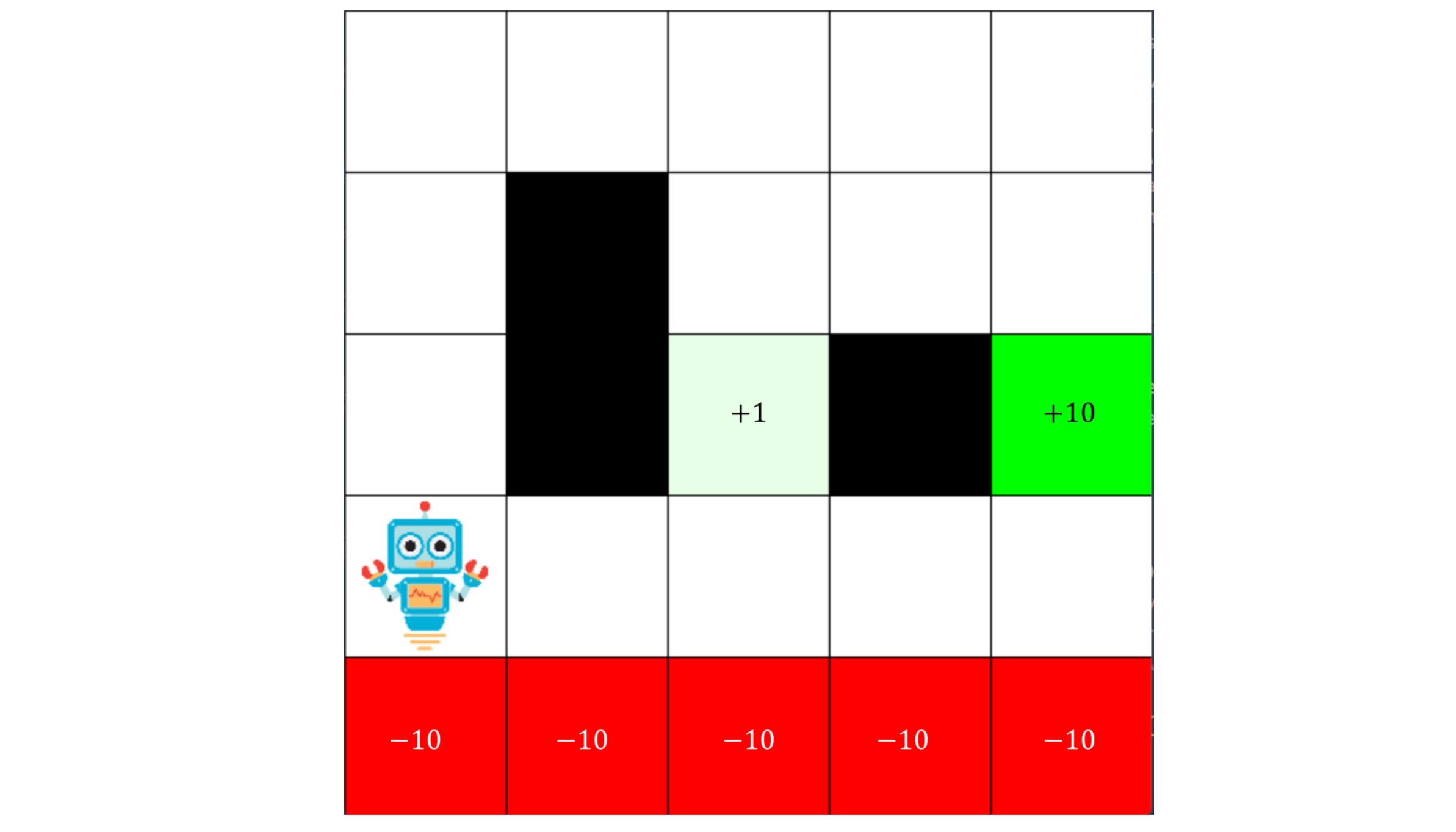

GridWorld Reinforcement Learning

This project is a reinforcement learning Python implementation of the GridWorld in the book “Reinforcement Learning: An Introduction” by Sutton and Barto. Continue reading GridWorld Reinforcement Learning

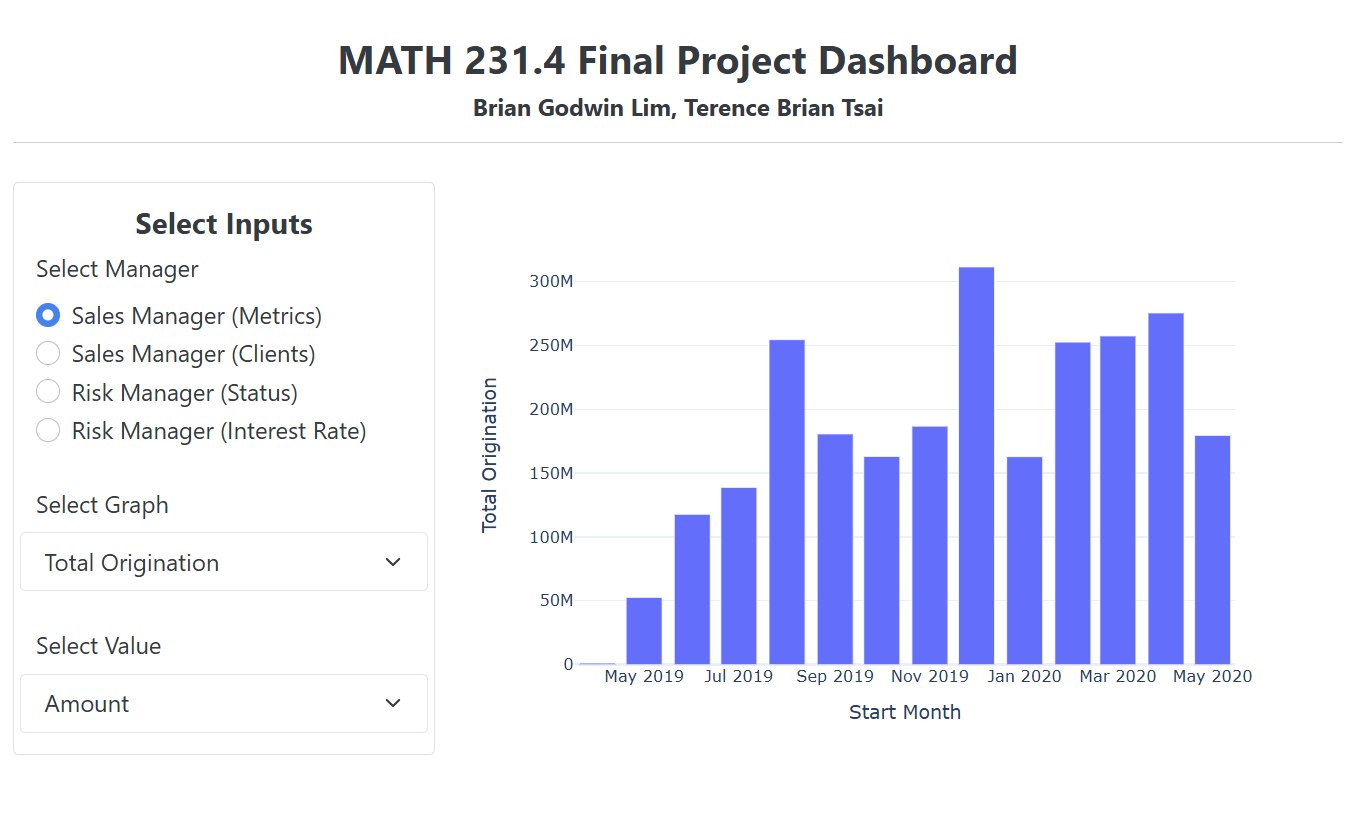

Analytics Dashboard

This analytics dashboard and the accompanying report investigate the key trends in the transactions of a micro-financing company. Continue reading Analytics Dashboard

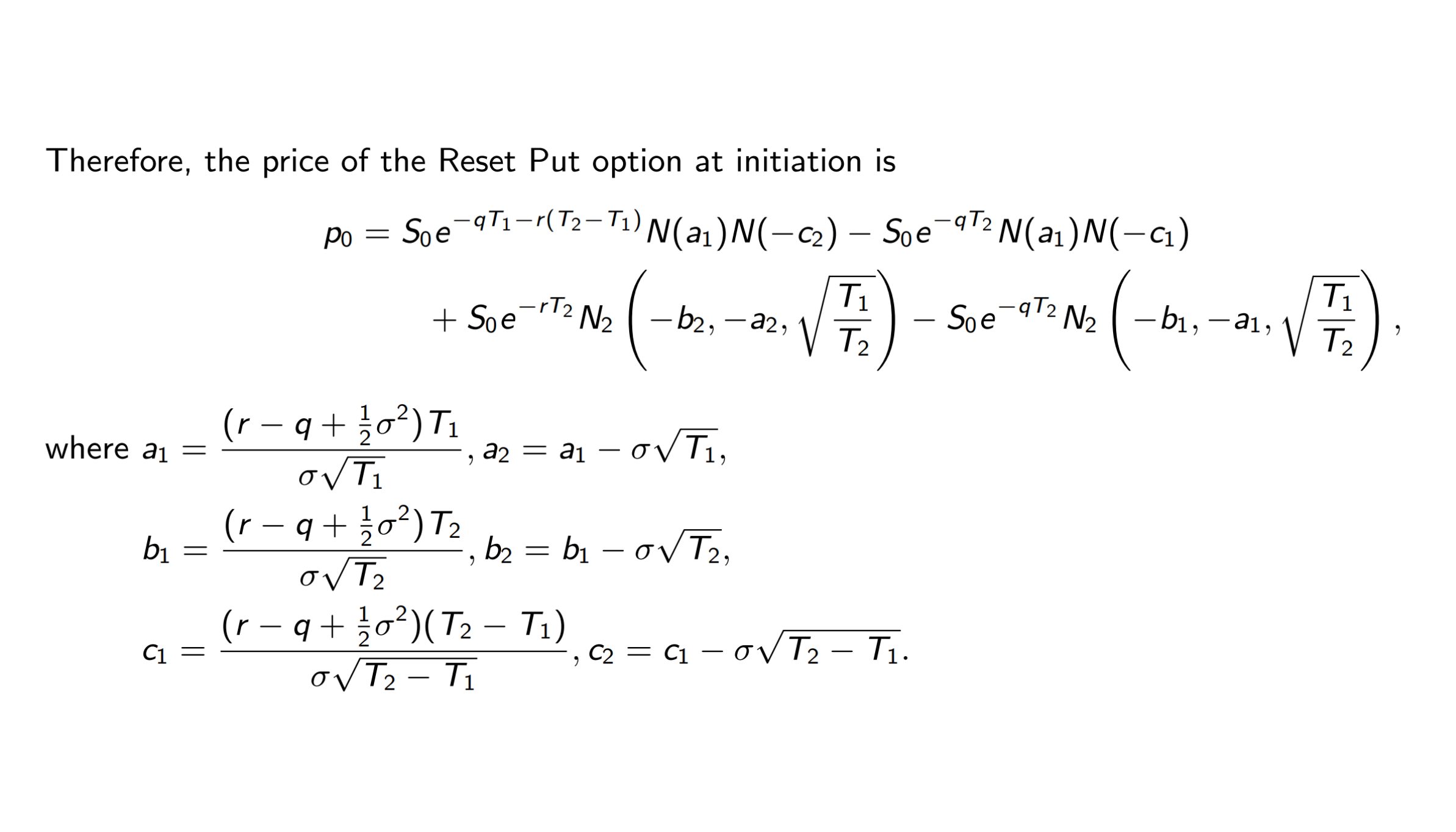

Reset Put Option

This project explores the reset put option, a type of exotic option. It also proposed several valuation techniques for this type of option. Continue reading Reset Put Option

Principal Component Analysis

This project conducts a Principal Component Analysis (PCA) on the World Bank World Development Indicators Dataset for some countries. Continue reading Principal Component Analysis

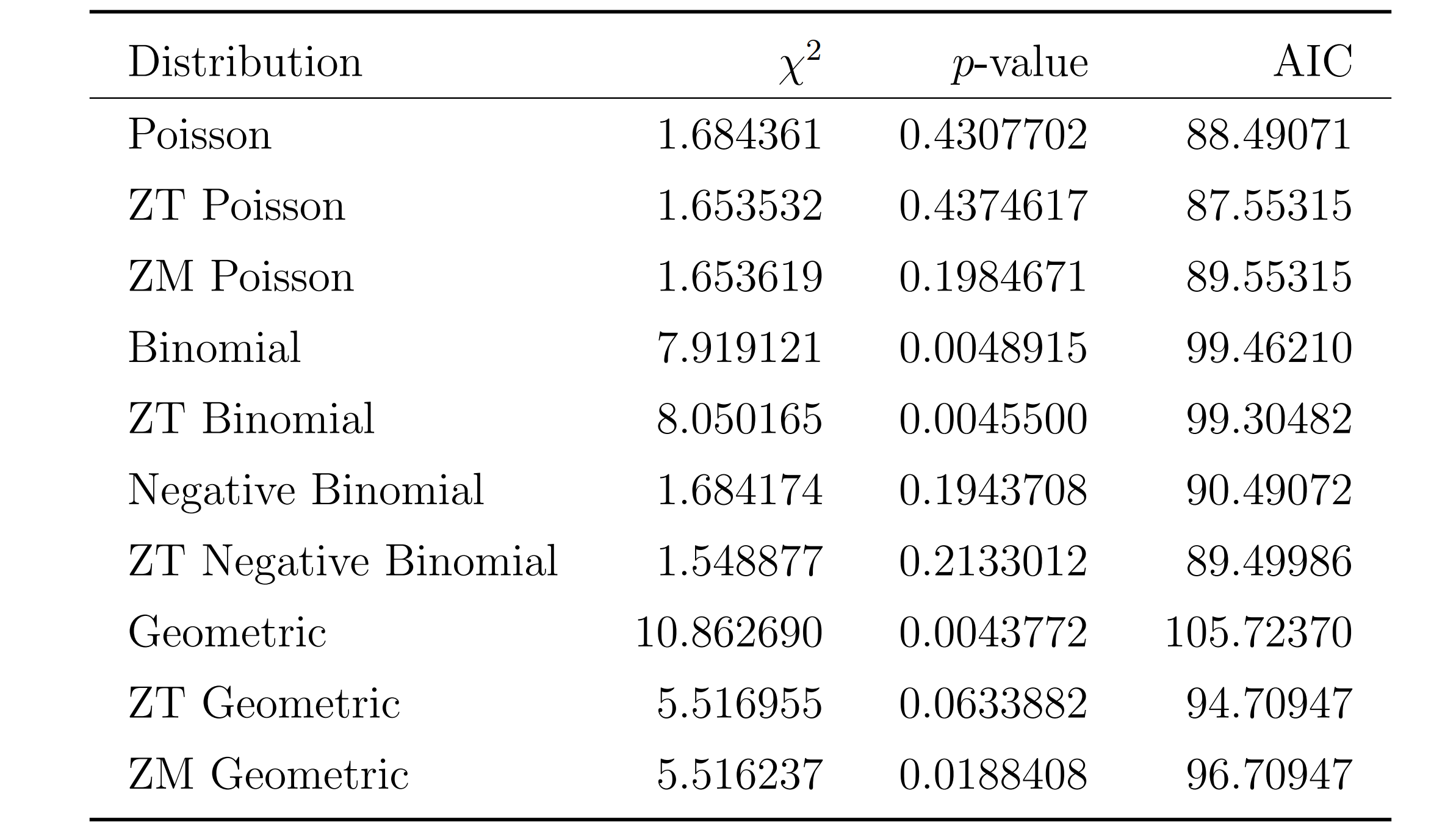

Operational Risk Model

This paper models the operational risk of an institution using the data on loss amounts due to Damages to Physical Assets under the Asset Management business line. Continue reading Operational Risk Model

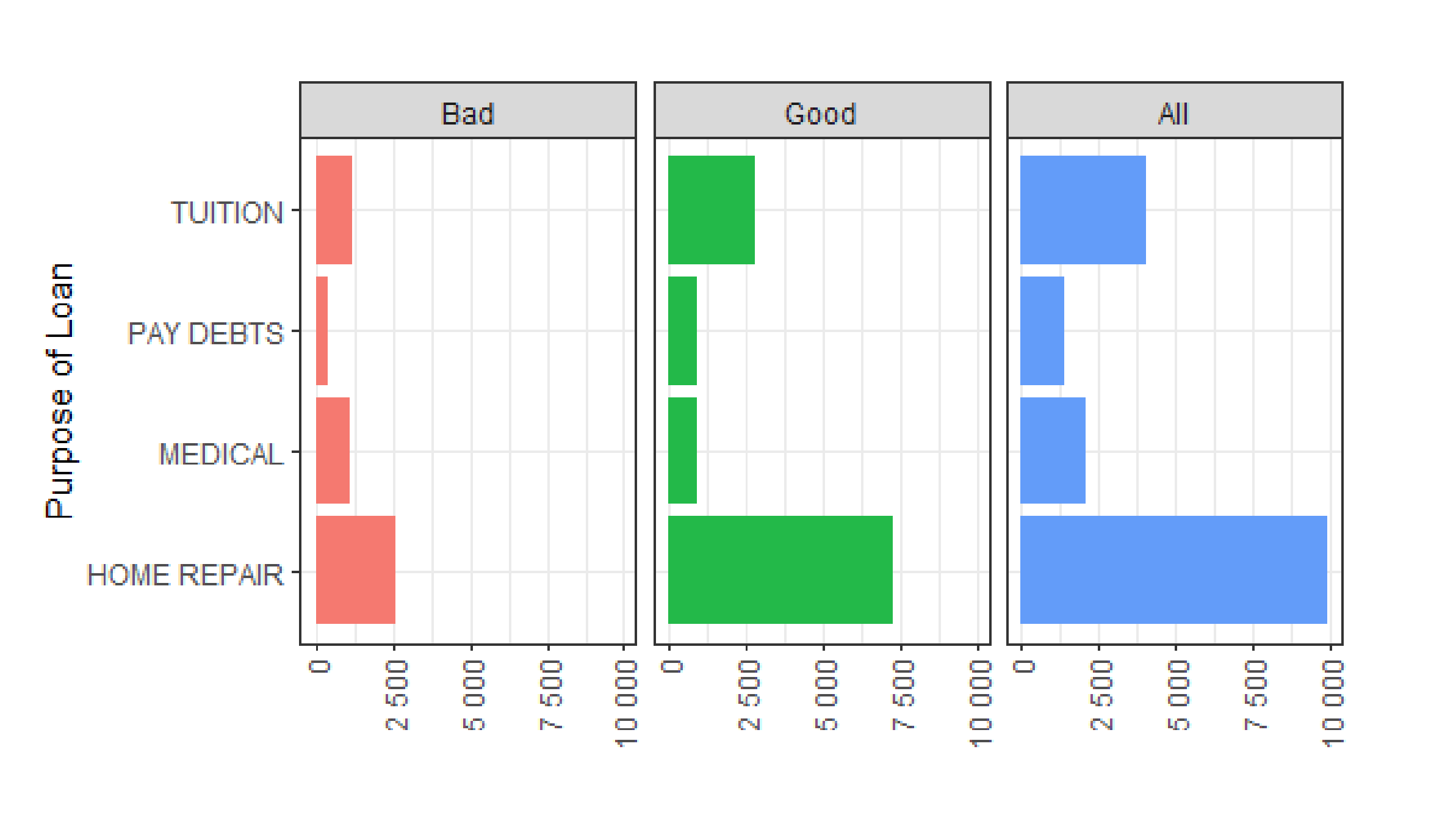

Credit Scorecard Model

This paper explores two credit scorecard models, segmented based on the purpose of the loan, using data on several loan accounts. Continue reading Credit Scorecard Model

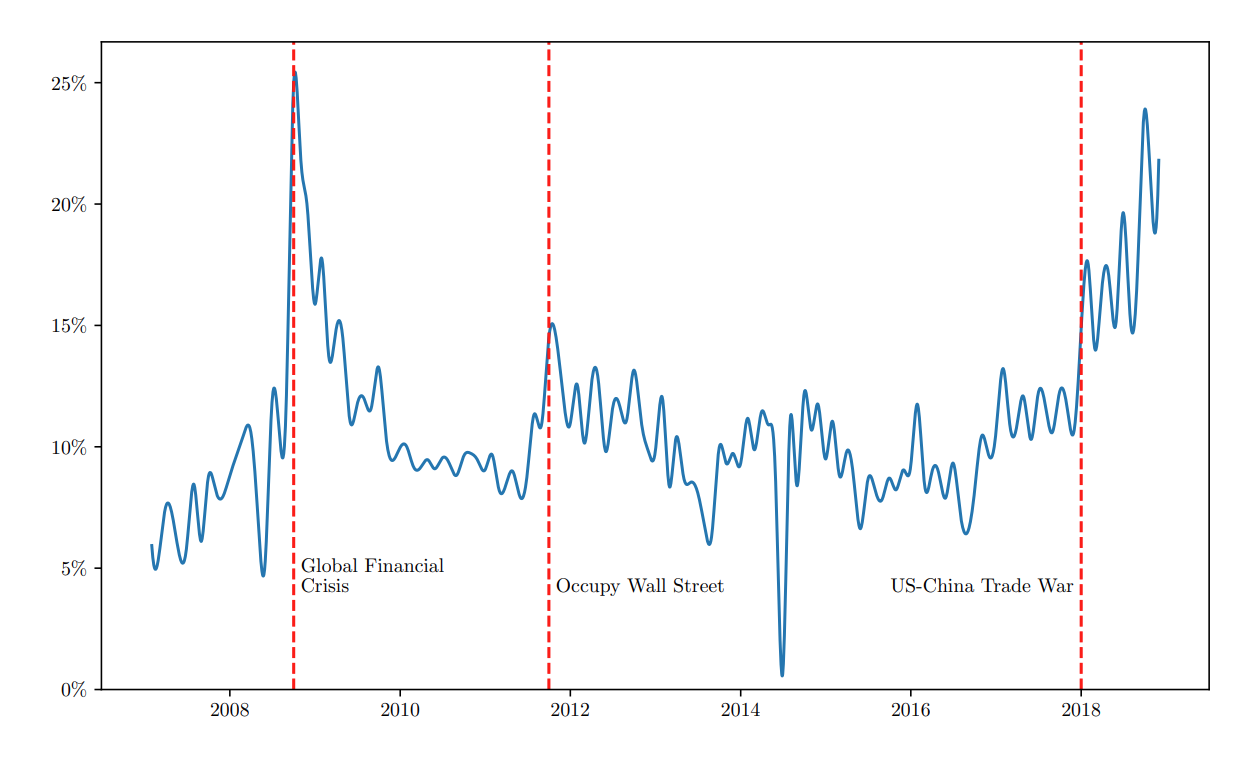

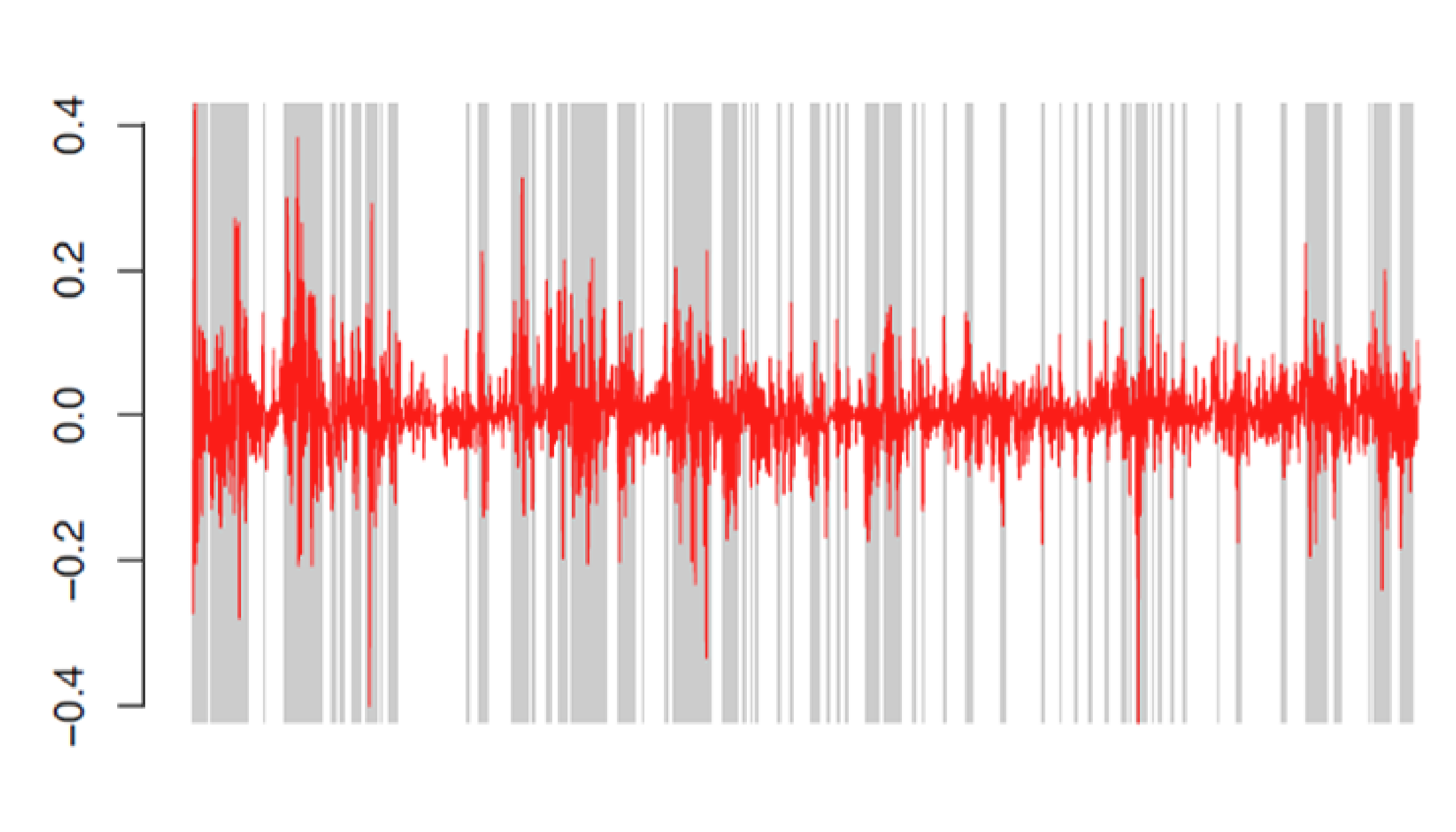

Forecasting Ethereum Return Using Linear and Nonlinear Time Series Models

Using several time series models, this paper produces the best model in forecasting Ethereum returns. Continue reading Forecasting Ethereum Return Using Linear and Nonlinear Time Series Models

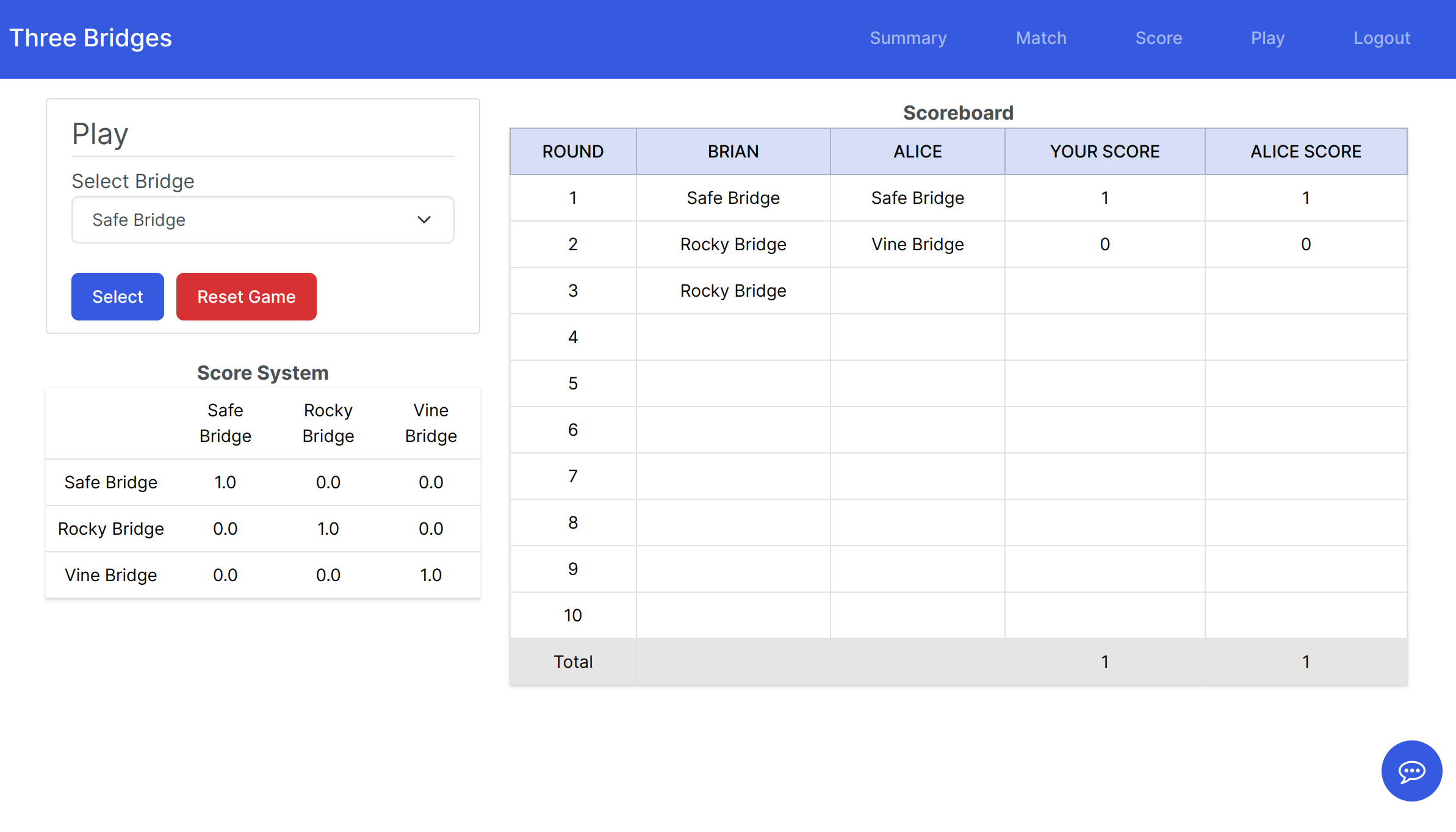

Three Bridges

This Flask web application offers a unique twist on the classic Prisoner’s Dilemma Problem, framing it within a captivating sailor versus pirate scenario. Continue reading Three Bridges

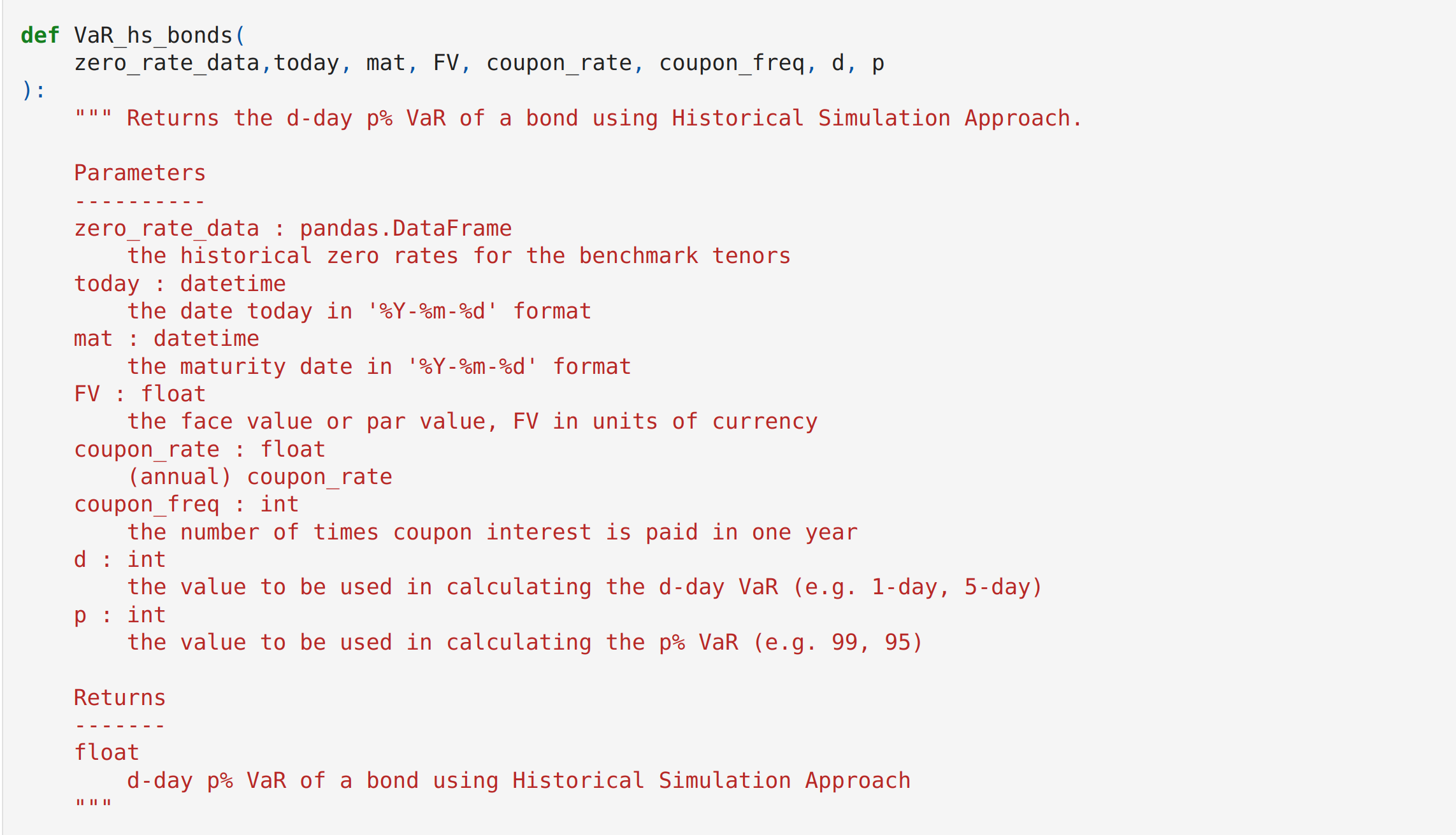

Value-at-Risk

This project calculates the Value-at-Risk (VaR) of several financial instruments using different approaches in Python. Continue reading Value-at-Risk

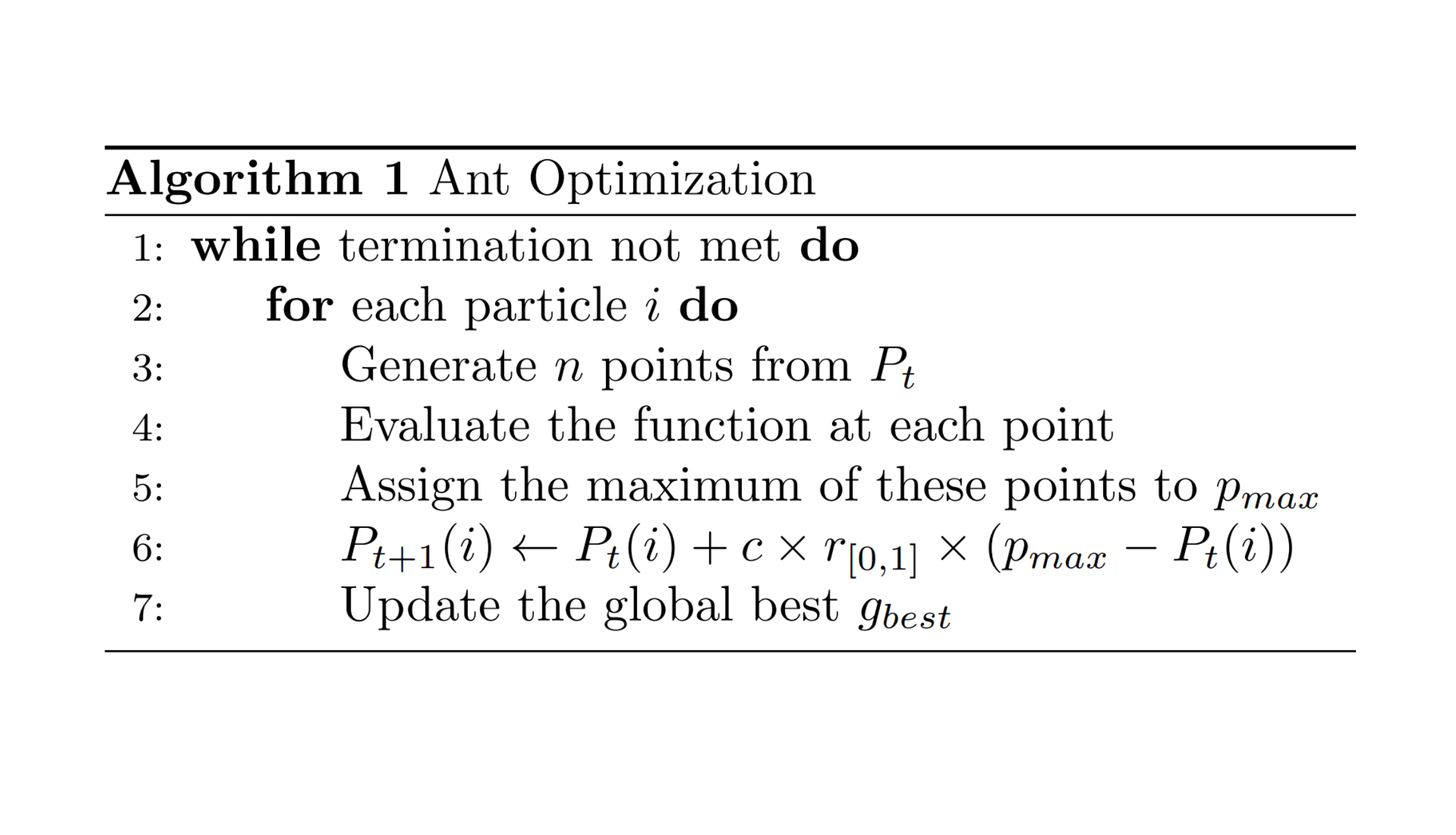

Ant Optimization Algorithm

The ant optimization algorithm is a novel optimization algorithm inspired by the communication system between colonies of ants using trail pheromones. Continue reading Ant Optimization Algorithm

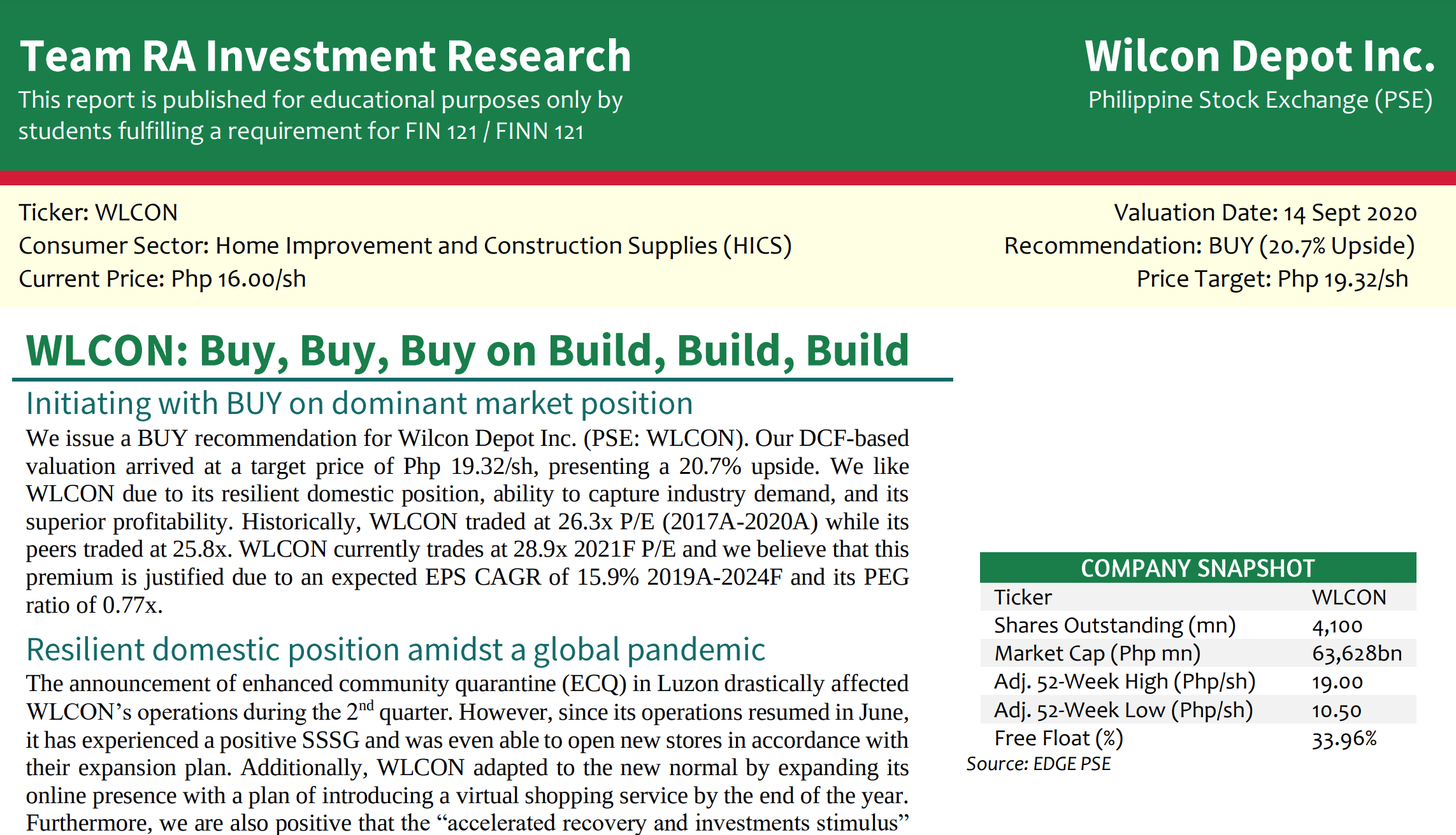

WLCON Investment Research

This is an investment research report on Wilcon Depot Inc. (WLCON) valuated on September 2020. Continue reading WLCON Investment Research

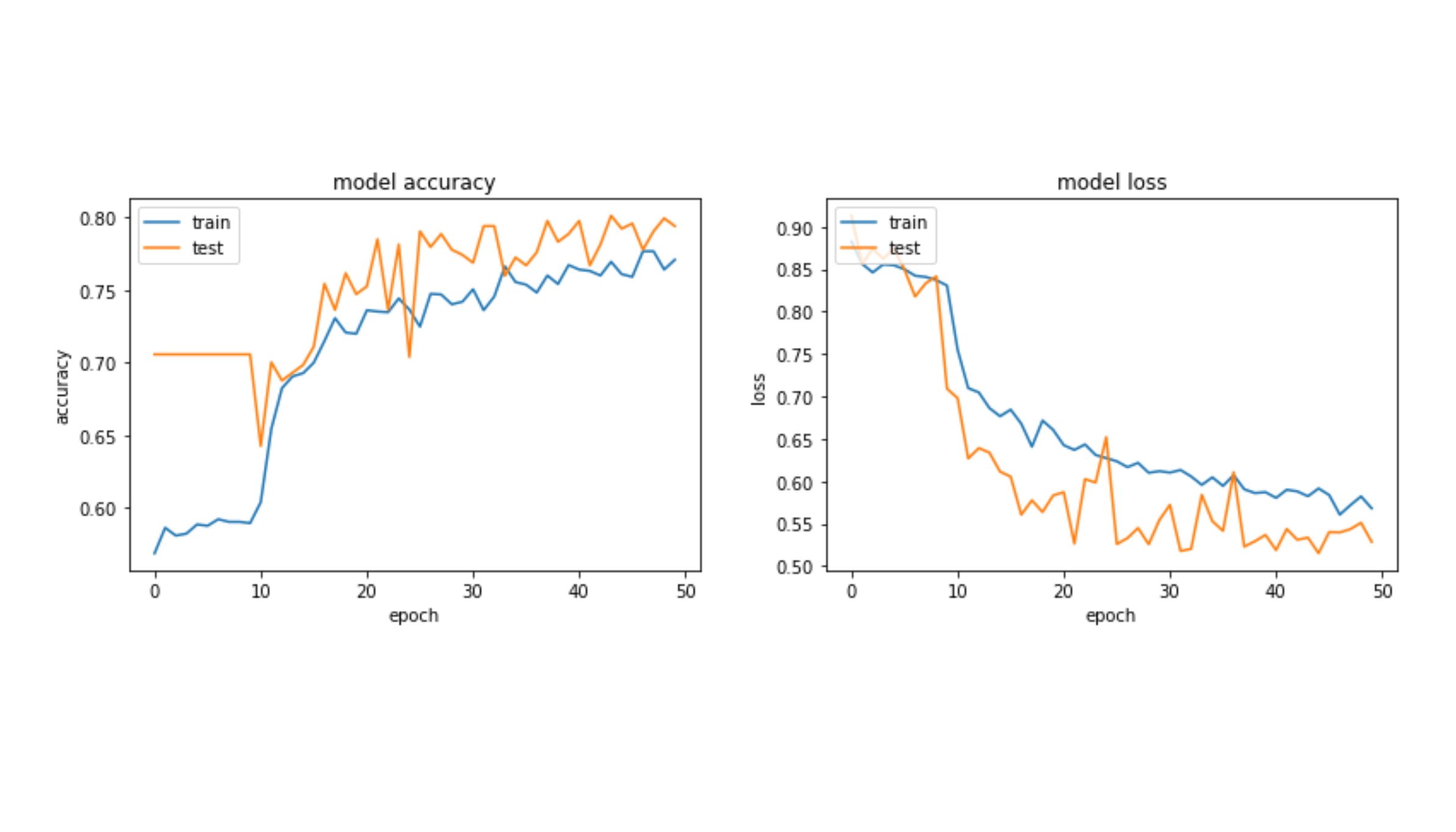

Trading Bot

This project explores an LSTM-based classifier for stock recommendation using historical price data and commonly used technical indicators. Continue reading Trading Bot

Determining The Securities Market Line Equation in the Philippine Market Using Polynomial Regression

This paper determines the securities market line (SML) equation in the Philippine market using three polynomial regression. Continue reading Determining The Securities Market Line Equation in the Philippine Market Using Polynomial Regression